Crypto-friendly bank is a financial institution that is open to cryptocurrencies and blockchain technology.

Contrary to traditional banks, crypto-friendly banks tend to provide a wide range of services to their customers regarding crypto.

On the other hand, this kind of bank, regardless of some risks, provides a great deal of advantages based on online banking, international banking, offshore digital banking, and managing digital assets for its customers. Crypto-friendly banks generally serve advanced online banking platforms.

Customers may manage their accounts through the Internet, international money transfers, and payments or engaging in financial activities can be carried out. With blockchain technology, it can be possible to focus on innovative financial services.

In addition to this, with blockchain technology, it can be possible to save digital assessments safely. All of these functions make financial transactions easy to manage or done quickly and easily with crypto-friendly banks.

Why Is It Important For Businesses To Work With A Crypto-Friendly Bank?

Working with crypto-friendly banks is important for businesses as they can benefit from a range of advantages thanks to this kind of banking. It might be feasible for businesses to ameliorate their financial positions with blockchain technology, and a chance to expedite offshore banking, and these provide businesses with a competitive advantage in the international market.

Crypto-friendly banks can collaborate with some businesses that serve the purpose of customer satisfaction.

In addition to this, this new banking system can be helpful to be adapted to future financial trends. All of these advantages benefit businesses in their transactions and enhance their income.

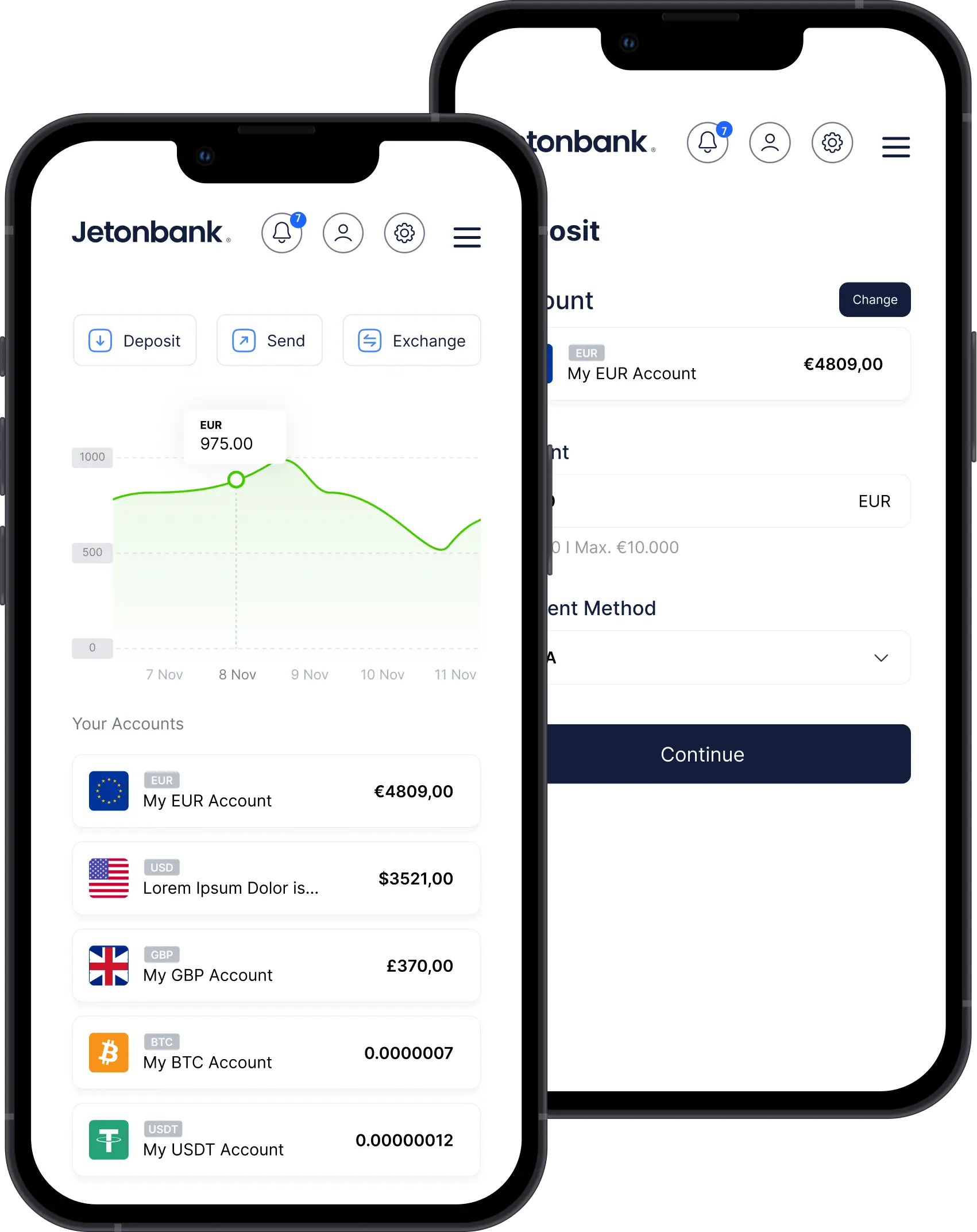

With the aim of this, businesses should pick a bank that is crypto-friendly. Jetonbank may be a great option as one of the best crypto-friendly banks as it has great advancements in crypto technology.

In addition, it can be a wise choice to work with Jetonbank as it can be referred to as the best offshore bank, and best digital bank, all of which are associated with the advantages mentioned above. So Jetonbank is an appropriate option for entrepreneurs.

What Are the Advantages of Crypto Banking?

Crypto banking, as mentioned above, makes it possible to execute effortless and budget-friendly financial transactions and crypto banking provides access to financial services available for more people, especially in the locations where access to banking services is limited.

Since investing in crypto assets requires generally low investment amounts which means that individuals and businesses must not exceed minimum investments, crypto banking provides a great advantage by providing them with the opportunity to invest even small amounts digitally.

In addition to what is mentioned, crypto banking enables consumers to make their financial transactions anonymously and confidentially.

Also, one can make international transactions thanks to the worldwide access advantage of crypto-friendly banks.

It is also open to innovative services with the facilities of blockchain technology and digital assets. This qualification of crypto banking creates opportunities for entrepreneurs and startups.

The last advantage of crypto banking is access to low trading volume markets. Markets with low transaction volume which are often ignored by traditional banking firms can take advantage of crypto banking.

How Can Businesses Benefit from Cryptocurrency?

It is inevitable to see people who complain about traditional bank transfers taking such a long time. Owing to this fact, one can understand that there is a requirement to have a practical way so that one can provide this kind of transfer.

The benefits of cryptocurrency make a great contribution to businesses at this point. It benefits businesses by providing quick transactions since it satisfies businesses and customers.

Blockchain technology saves all the transactions perspicuously and unchangeable. Because of this reason, it paves the way for businesses to check their financial accounts easily and safely.

Businesses that are focused on customer satisfaction, can provide customers with more payment options thanks to the benefits of several cryptocurrency advantages.

It increases business and customer satisfaction as choosing cryptocurrencies makes payments more practical and safer.

With several acquisitions such as mentioned advantages businesses can affluently benefit from cryptocurrencies by considering all of these opportunities wisely.

Why Is Crypto Better Than Traditional Banking?

Being subject to the control of the central authorities, traditional banking is not as non-limiting as the crypto banking system.

On the contrary, the traditional banking system, crypto banking, gives customers financial freedom and control.

Traditional banks supply transactions as international money transfers and these transfers take a longer time than crypto-friendly banks’ money transfers. Crypto banking can speed up the transactions and reduce the costs.

Also, for some individuals living in the regions where it is still being developed, access to traditional banks may not be easy at all.

On the other hand, crypto banking provides a wide participation with its accessible services. Crypto banking is a banking system that offers many opportunities to make transactions without the requirement of physical branches. These opportunities reduce the expenses of businesses.

In opposition to this, generally, traditional banks have to spend more on physical branches and infrastructure. Traditional banking tends to protect its old customs and wants.

This kind of banking system generally has been maintaining certain standards, protocols, and customs relationships for many years.

However, this system may cause problems in adapting to technological and financial innovations. That is exactly why crypto banking is better than traditional banking.

Because crypto banking appeals to young and technology-accustomed investors, it is a better option to adapt to modernist banking systems.

What Is the Difference Between A Bank And a Crypto Bank?

There are a great number of differences between a basic bank and a crypto bank. To give an example, crypto banks work with digital currencies, they are managed by computer technology and they have a non-central role.

Crypto banks operate with digital currencies such as Bitcoins or Ethereum in a digital wallet.

As with every digital transaction, digital banking systems such as crypto banking is a more sophisticated and practical system than traditional banking systems.

Based on this, it can be said that crypto banks bring more convenience to the investment environment compared to traditional banks.

In simpler terms, one can easily and quickly carry out any money transfer in a faster and more cost-effective way.

Nonetheless, a traditional bank allows an individual to use basic cash and credit cards contrary to crypto banks. These banks are often monitored by the government and transactions may require a certain amount of time in comparison to crypto banks.

In other words, traditional banks do not possess as many technological capabilities and advantages as crypto banks do.

Also, traditional banks have some limitations and complexities in customer transactions due to their rigorous regulatory frameworks.

What Transactions Can Be Done with Crypto-Friendly Bank?

Because crypto-friendly banks have a huge expediency, it can be said that many kinds of transactions can be done with crypto-friendly banks.

For instance, customers can make their financial transactions which can be done with traditional banks. On the other hand, they also can make crypto transactions with crypto-friendly banks.

As a result, they can access many opportunities such as purchasing and selling, spending cryptocurrency, accumulating funds, converting money to gain interest, and investing in some projects.

For instance, individuals can create their digital wallets to store their cryptocurrencies in, make their daily spending, and store their cryptocurrencies in shopping centers or online shopping platforms.

Besides that, it is possible that the individuals, who use this type of banking system, buy or sell various cryptocurrencies through these banks’ platforms. What's more, when individuals need to turn their cryptocurrencies into traditional currencies, they can benefit from the advantage of converting coins and withdrawing them.

Crypto-friendly banks can also offer customers the opportunity to lend money on their crypto assets or earn interest for holding their cryptocurrencies.

Lastly, customers have a chance to invest in various crypto projects such as ICOs or joining token offerings.

Best Digital Crypto Bank for Beginners

The choice of the most suitable crypto bank for beginners may vary depending on individuals’ specific needs and preferences.

For people who are taking their first steps into crypto banking, the platforms that stand out for their simple use and reliability are more appropriate than the others.

After simple steps and transactions, they can take new steps to other complex operations. However, the bank they use should be thoroughly researched, user comments should be taken into account and sufficient information should be obtained about its activities, advantages, and disadvantages.

The bank which is called Jetonbank and mentioned above is one of the best choices for beginners and other users because it offers a variety of training and analysis materials aimed at beginners. It provides access to free educational resources that can help individuals to understand the platform and trading strategies.

Also, Jetonbank provides users with a free demo page in which they can implement trading strategies and test the platform before trading with real currencies.