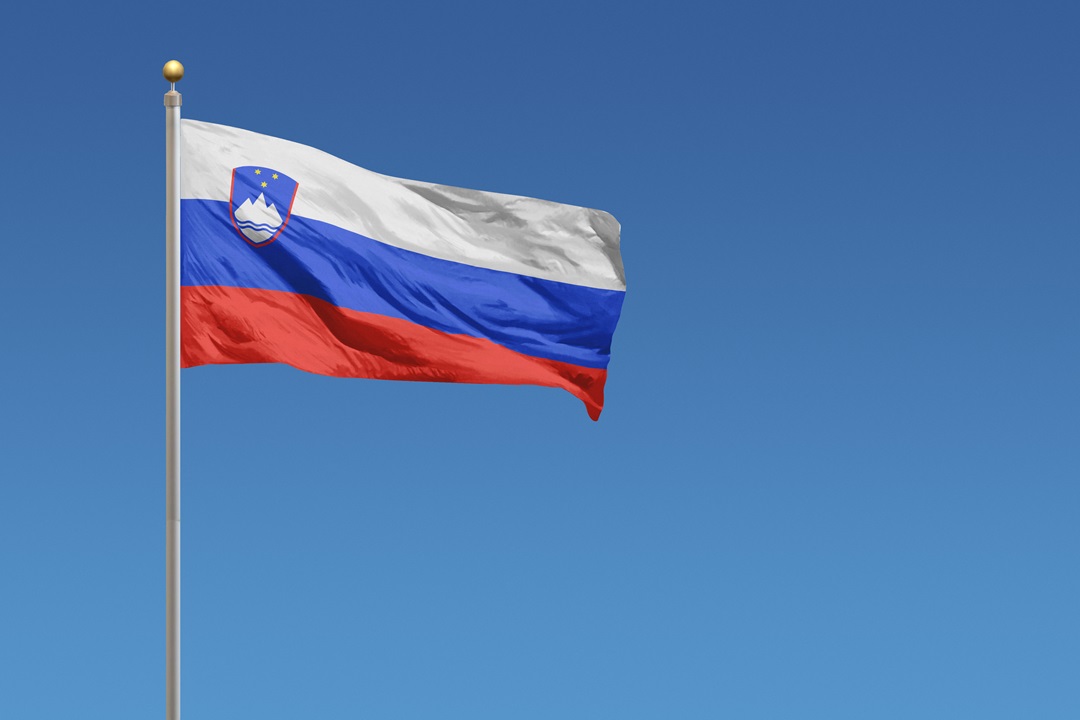

Offshore bank account opened in other countries are a great source of income for investors. Because the desire to benefit from the advantages in different countries arises. Countries such as Slovenia will come first among these countries. The number of individuals who want to open an account due to the privileges offered by the country is quite high.

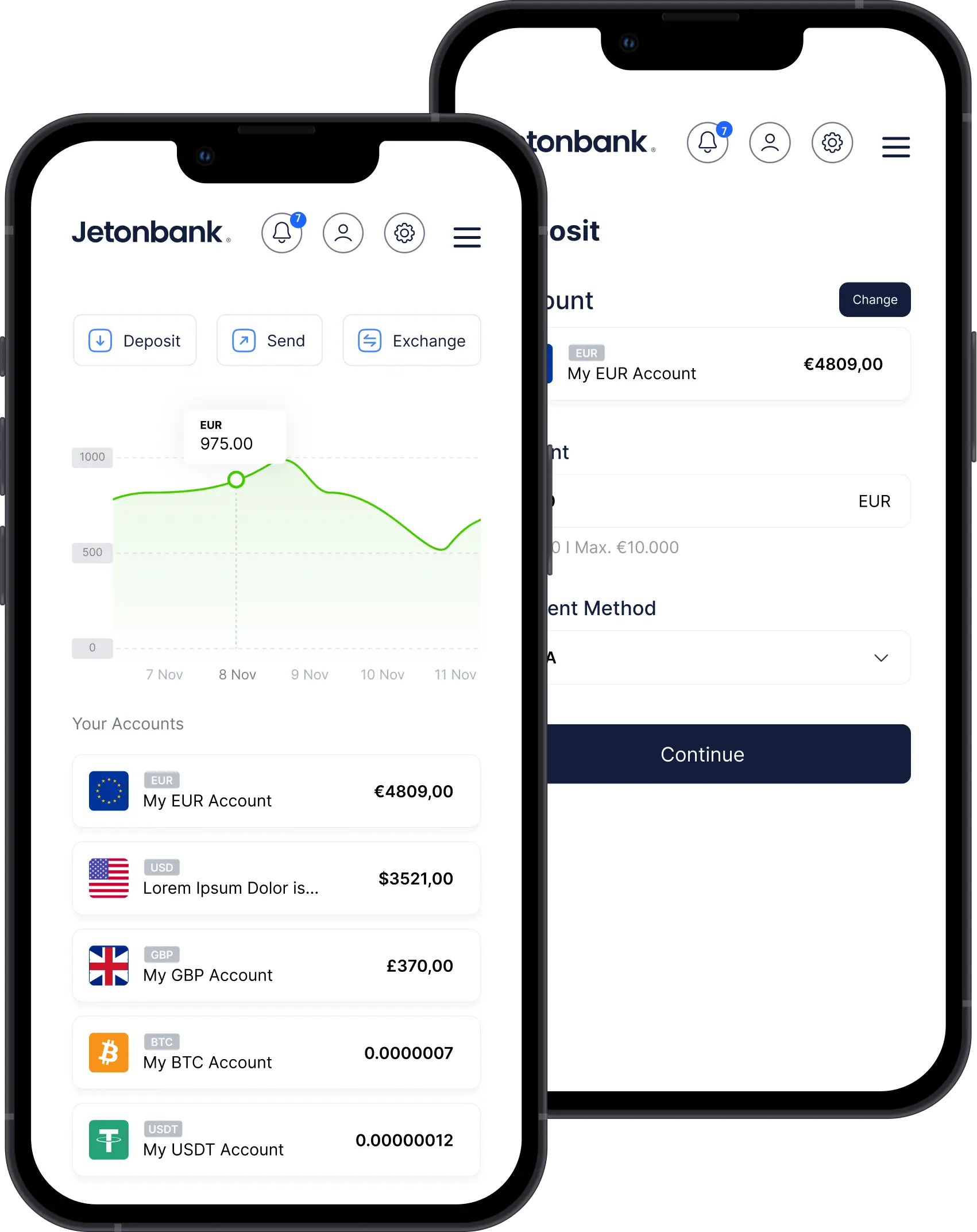

However, it is common for people who want to open an account to open it without living in that country. Practical use occurs with the Slovenia offshore bank account opened remotely. It is possible to make the process simpler, especially by getting support from companies such as Jetonbank. We will review for you how to have a personal account in Slovenia.

In this way, all your questions about the subject will be answered and you will have an idea. It is important to learn the process to create a healthier and more successful account. Opening an account from the wrong places in a novice way can harm you.

Offshore Banking in Slovenia

Slovenia offshore banking is one of the frequently wondered topics. Due to the privileges offered by the country, creating and managing remote accounts offers many advantages. It is simple to take advantage of these advantages thanks to Jetonbank. With the developing internet network and websites, we can easily perform various transactions. Creating a remote account is in the first place among these transactions. Transition to the digital age in banking transactions offers convenience. Thanks to smart mobile phones, tablets and computers, accounts appear in a manageable version.

Remote service is essential in offshore banking in Slovenia transactions. If you live in that country or are a citizen of that country, the account can be opened through physical and normal procedure. However, when you want to open it remotely, the offshore system will be applied.

Therefore, you should pay attention to the intermediary company you will get help from. Especially people who are interested in e-commerce frequently apply offshore. It is also possible to profit from tax rates and different currencies in other countries.

For example, it is normal for an individual living in Turkey to want to open an account in the United States, the United Kingdom or Slovenia for investment purposes. Income will be maximised by investing in different currencies. In addition, access to different customers will cause your audience to grow and the number of orders to increase.

Slovenia online bank account transactions are not only preferred for cash purposes. Its suitability for investment instruments such as cryptocurrency is one of the advantageous structures it offers. All you have to do is open an account by choosing a bank that suits you.

How to Offshore Banking in Slovenia?

The question of offshore banking in Slovenia is one of the topics that global company owners and personal investors are curious about. For this reason, we will give you information about the procedure.

First of all, you need to choose a quality, successful, experienced, reliable and professional bank. Depending on the situation, help can also be obtained from companies that offer services from digital platforms. But it would not be wrong to say that the best bank to recommend is Jetonbank.

We see that the company has a very high level of quality in terms of vision and mission. For this reason, you can easily apply to the bank and activate your account.

You can choose the country you want for offshore banking. The country you choose depends on your purpose and intentions. An e-commerce company that wants to expand to the Asian market wants to open an account in China. Buyers of quality wholesale products at affordable prices may prefer countries such as Bulgaria, Slovenia, Turkey.

People who desire income with valuable currencies such as Euros tend to countries such as Italy, France, Belgium. The choice that will occur here is completely directly proportional to your purpose. If you want low tax rates, countries such as small islands Bermuda, Virgin Islands will generally be preferred.

After logging in to the site of the bank where you will open an account, the process is started by choosing the country. It is mandatory to enter personal information or company information if it is a company account.

Activate your account by submitting the documents requested from you via digital contact channels. You can then make the desired deposits, withdrawals and all kinds of international money transfers.

Which Bank is the Best for Offshore Banking?

The question of which is the best bank for offshore banking transactions is being asked in large numbers. In response to this question, of course we will answer Jetonbank. The process is successfully managed with the bank’s high level of service quality. In addition, users benefit from advantages thanks to the extra privileges offered by the bank.

Apart from low commission fees, it is one of the positive effects of the services offered in different countries. You can open an account online from the company’s website to have an account in any country you wish.

Online Offshore Bank Account in Slovenia

People who want to open a Slovenia online bank account can complete the process with Jetonbank. As the offshore system is known, it appears with remote banking. It is the name given to the account opening transactions of a person living in one country in another country.

For this reason, having a say in another country has become simple.

Although the digital environment is safe, it is seen that malicious institutions victimise some individuals. You should be careful not to encounter such cases.

Can a Non-Citizen Open a Bank Account in Slovenia?

It is possible for people who are not citizens and do not live in Slovenia to get online bank account Slovenia service. Jetonbank will help you with this in a short time. The reason or reasons for your desire to open an account are not important. Some of the most common reasons are as follows;

- Receiving services in another country

- The currency of another country is more valuable

- Foreign currency investment and different investments

- Transactions such as cryptocurrency

- Expansion of the e-commerce network and addressing different customers

- Companies’ desire to offer global services

- Taking steps for institutionalisation and branding

- To generate more income

- Increasing the profit margin and growth of the company

- Specific and personal reasons

- Special advantages offered by the country

- Low tax rates

- Desire for international dominance

Slovenia Online Bank Account Requirements

Slovenia's requirements for a bank account are curious. The first structure required for these transactions is a quality bank or brokerage firm.

Choosing an expert company such as Jetonbank is important and necessary. The second requirement is a device to access the internet. Smart mobile phone, computer, tablet etc. Device is needed.

The transactions are completed by entering the bank’s website from the device. If a company account is to be opened, it would not be wrong to say that information about the company is also required. Since personal information and contact number will be requested when creating an account, it is essential to have your phone number.

In addition, it should not be forgotten that specific information such as identity number is needed according to the situation. Bank accounts in Slovenia will be active once all requirements have been fulfilled.

Jetonbank offers its users the necessary financial services to open an offshore bank account. Create your offshore account online with Jetonbank immediately, without unnecessary paperwork.